Our Framework and Targets

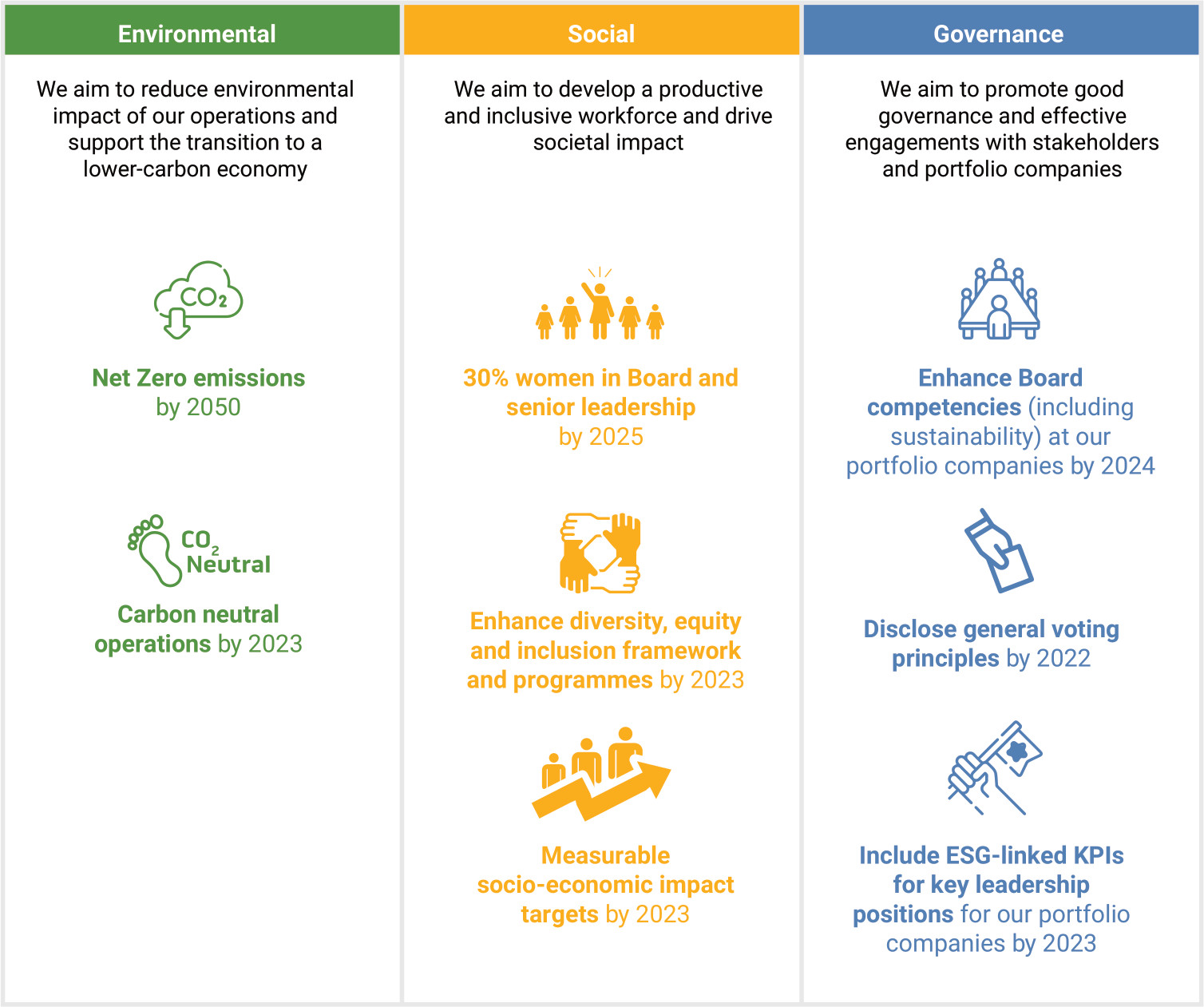

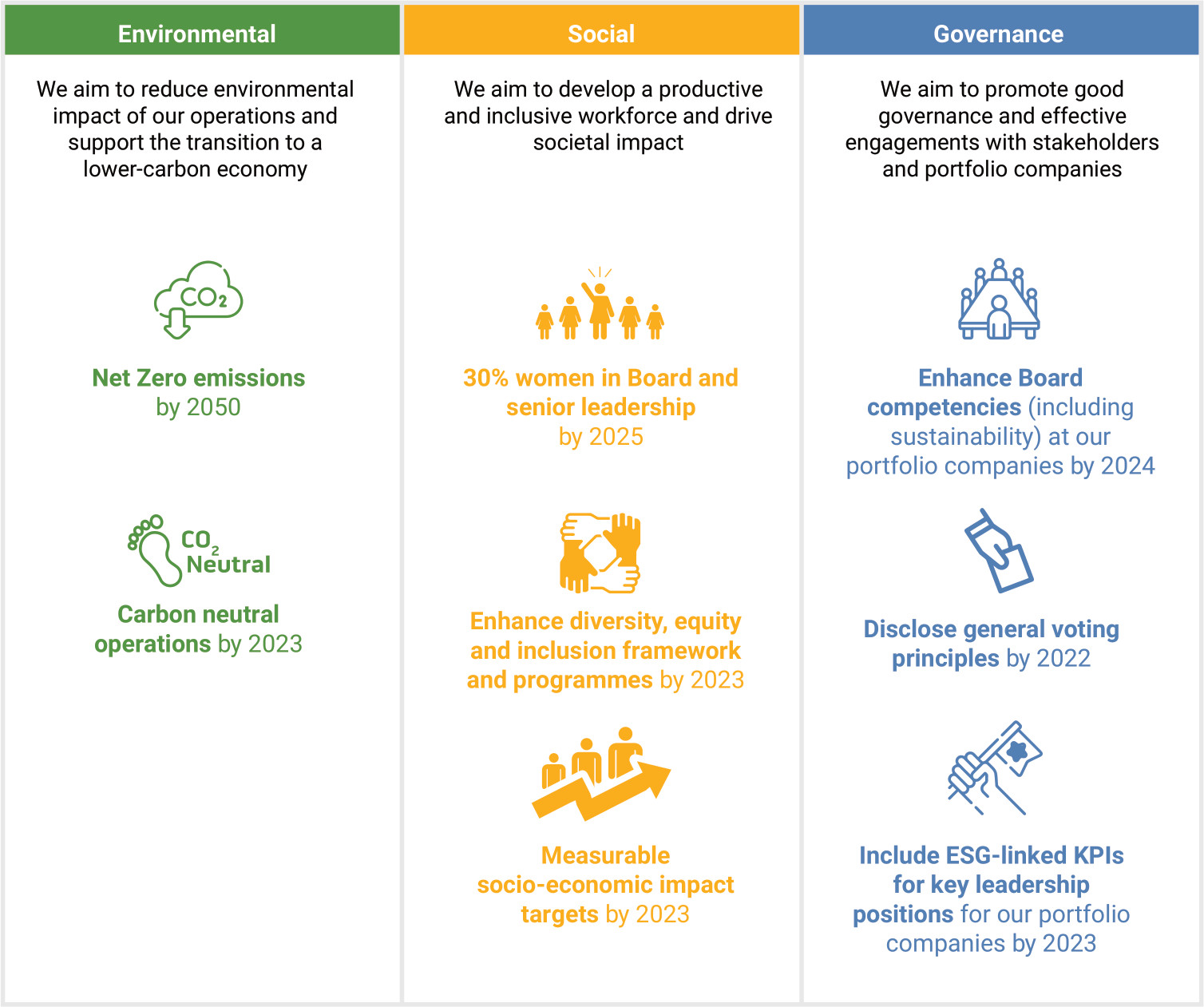

We have also committed to the following short, medium, and long-term targets across the E, S and G pillars, to guide and focus our Sustainability efforts over the coming years. These targets were identified to align Khazanah’s aspirations with our stakeholders, including the Government of Malaysia, as well as other national institutions. However, we acknowledge the fast-evolving ESG space and will adapt our targets and actions accordingly to ensure they remain relevant for the long-term.

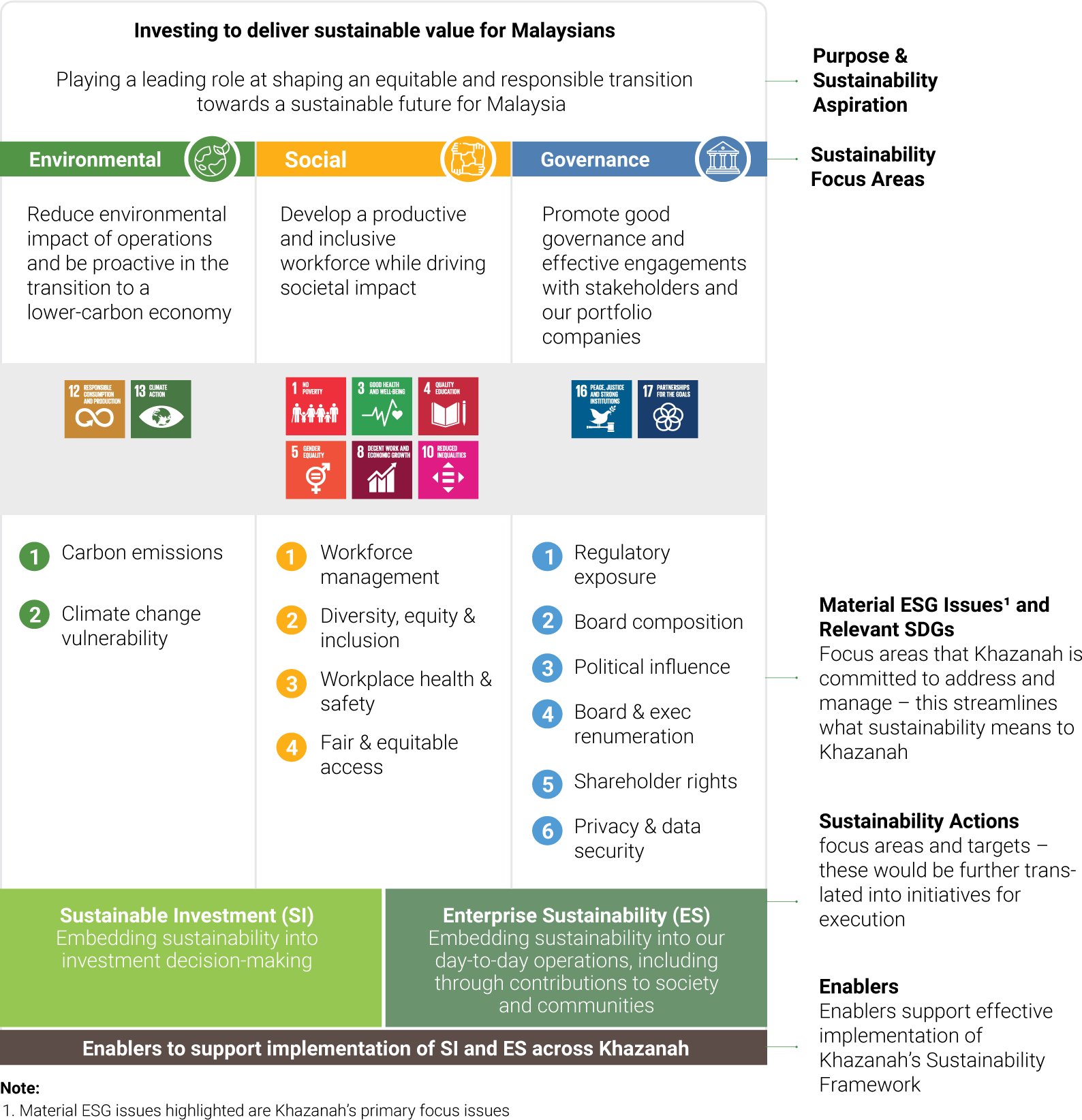

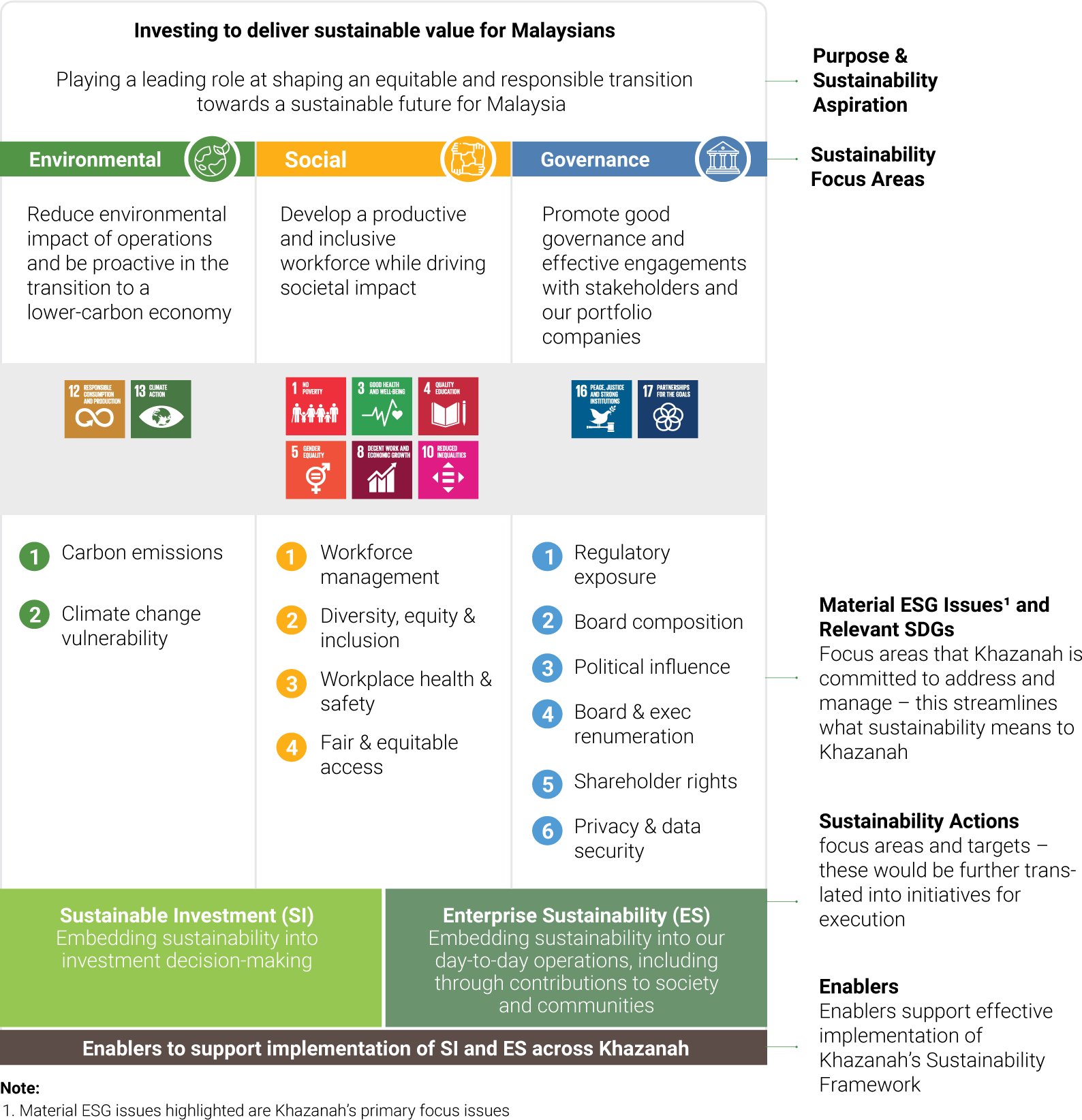

Khazanah’s approach to Sustainability is outlined through our Sustainability Framework, anchored on the Environmental, Social and Governance (“ESG”) pillars.

Material Issues Definitions

| Carbon

Emissions |

The absolute greenhouse gas (GHG) / carbon emissions associated with a company’s operations (direct or indirect) or investment portfolio |

| Climate Change

Vulnerability |

Exposure against climate-related physical risk such as flooding, forest fires, water scarcity, and other natural disasters and transition risks such as policy changes to tackle climate change, shifts in market preference as the world moves towards a lower-carbon future, potentially resulting in stranded assets |

| Workforce

Management |

Engagement and treatment of employees, including remuneration, benefits & wellbeing (e.g. staff living conditions, forced and child labour, recruitment, fair benefits, equitable treatment of staff) |

| Workplace

Health & Safety |

Management of workplace health and safety issues arising from operations, including adequate policies & procedures, sufficient provision of PPE, safe work environment |

| Fair and

Equitable

Access |

Provision of access and opportunities to products and services that is fair and equitable across different groups in society (e.g. access to basic infrastructure such as utilities, healthcare, digital connectivity, transportation, food and shelter) |

| Diversity and

Inclusion |

Promote diversity and inclusion without any forms of discrimination towards individuals, supporting racial and gender diversity, as well as unbiased access to opportunities for individuals across various backgrounds and income groups (including non-Malaysians working in Malaysia) |

| Regulatory

Exposure |

Adherence to and complexity of relevant laws, policies, and regulations for related industries and companies in host countries |

| Board

Composition |

The Board should comprise of experienced, qualified, and fit-for-purpose directors who are unconflicted and have capacity to guide the company for long-term success in the best interests of the shareholders and the company |

| Political

Influence |

Involvement in actions, policies, or decisions, most often government officials, legislators or members of regulatory agencies, by politicians or politically-linked individuals, and thus subject to change when there are changes to the political situation / environment |

| Shareholder

Rights |

Equity ownership structure and its potential impact to commensurate with shareholder rights and the interest of other investors |

| Board &

Executive

Remuneration |

Remuneration designed to overcome the principal-agent problem, and to align interests of management and shareholders. It should be fair, transparent, and commensurate with time, skill, effectiveness, and company size & performance |

| Privacy & Data

Security |

Collection and use of personal & financial data (including customers & employees), protection of privacy and vulnerability to data breaches |

Sustainability Targets